Forget everything you’ve heard about artificial intelligence (AI) stealing Wall Street jobs. The real story isn’t about employee replacement, but a potential skills renaissance. While the financial press has been fixated on a dystopian portrayal about machines taking over trading floors, something far more interesting is happening in the trenches of investment banking. Analysts aren’t […]

If you’re an investment banker, you know that valuation is the beating heart of most major financial decisions. Whether you’re negotiating a merger, prepping for an IPO, or advising clients on a buy/sell decision, valuation is the North Star guiding your way. But the thing is, valuation isn’t just an exercise in crunching numbers anymore. […]

To the average person, the words dealmaking and investment banking conjure images of secret negotiations and backroom deals. While this portrayal isn’t entirely off, it reflects the informal networking side of dealmaking that was common in earlier times. Behind the scenes, formal negotiations in boardrooms were the real battlegrounds. In today’s warp-speed world, with the […]

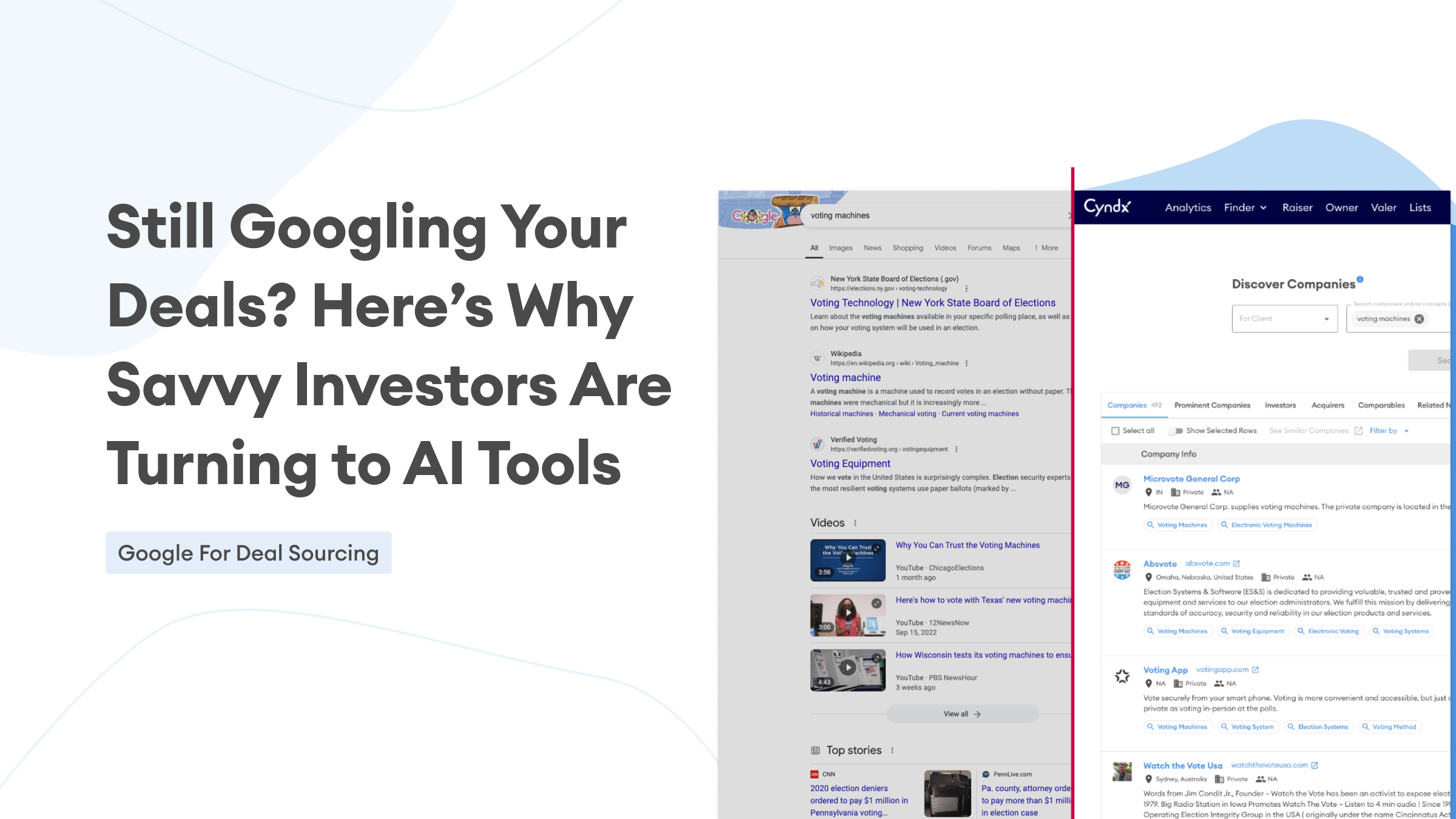

If you’re still relying on Google to source your next big deal, it might be time for a serious upgrade. Once the undisputed champion of search engines, Google has become outdated for today’s high-stakes financial game that demands a lot more from search engines. The modern dealmaker needs something beyond broad search results and countless […]

As we hurtle towards the middle of the decade, the investment banking sector finds itself at a crossroads of transformation that is set to alter the space forever. The coming years promise not just incremental change but seismic shifts that could redefine the landscape of finance. From digital innovations to sustainability mandates, the trends of […]

The effectiveness of investment banking firms hinges significantly on the caliber and volume of investment opportunities that come their way. Assessing a wide array of potential deals increases the likelihood of pinpointing the companies with management teams, substantial growth potential, and financial profile to be able to, thereby enhancing the overall successful completion of a […]