There’s an old saying in the world of finance: “Know the value of what you own, or someone else will.” In other words, the secret to success in any dealmaking situation — whether you’re buying, selling, or investing in a company — is understanding its true worth. Yet, while this may sound like basic Business […]

PHOTO: TIMA MIROSHNICHENKO When SpaceX’s was envisioned, the ambitions were not tied down by earthly concerns like traditional funding constraints. In fact, a $750 million private credit deal in 2021 allowed SpaceX to scale its operations without relinquishing equity. Similarly, when Airbnb faced a pandemic-induced nosedive in 2020, a $1 billion private credit facility provided […]

PHOTO: TIMA MIROSHNICHENKO After years of playing it safe, mergers and acquisitions (M&A) activity is finally gearing up for a revival. The latter half of 2024 saw a welcome uptick in deal volume, offering a glimpse of the dealmaking frenzy expected to unfold in 2025. Optimism is high, with forecasts predicting a 15% jump in […]

PHOTO: CLEM ONOJEGHUO If private equity’s guiding mantra is diversification, fractional art — paired with the digital renaissance of non-fungible tokens (NFTs) — might be the masterpiece that investors never knew they needed. With the allure of alternative investments growing stronger, savvy investors are finding that traditional portfolios need a splash of creativity. And what […]

As the new year approaches, finance professionals are staring down a rapidly evolving business landscape that could promise enormous challenges and equally profound opportunities. For the executives steering their companies through the unknown, the key questions are: how do you prepare for growth? What strategies do you put in place to stay competitive? And perhaps […]

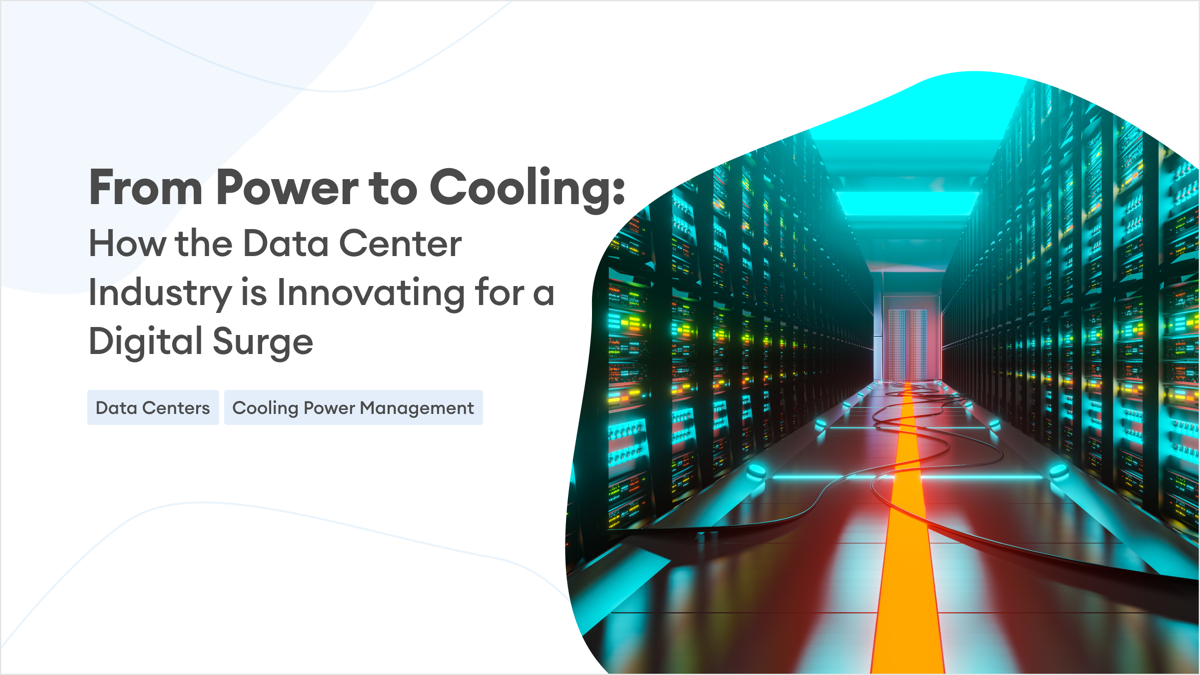

In November, we started to look into data centers and all of the industries that support the space. However, it’s such a booming industry, we decided to do a deeper dive using our research platform. To give you a general sense of this sector’s growth, it’s expected that the data centers powering generative AI will […]

The classic due diligence process, a bedrock in corporate development, has long demanded legal, financial, and operational analysis to minimize risk and reveal valuable insights. This traditionally manual and time-intensive process often requires gathering documents, verifying financial statements, investigating legal liabilities, and analyzing countless other data points. Both resource- and labor-intensive, due diligence involves team […]

The global data center industry is in high gear, rapidly innovating to meet skyrocketing demand from cloud computing and data-intensive applications such as energy-hungry generative AI. As digital needs grow, so do the requirements for efficient cooling, reliable power, robust security, and advanced AI processing capabilities. Within every industry — such as data centers — […]