If you’re still relying on Google to source your next big deal, it might be time for a serious upgrade. Once the undisputed champion of search engines, Google has become outdated for today’s high-stakes financial game that demands a lot more from search engines. The modern dealmaker needs something beyond broad search results and countless pages of untailored information. They need precision, speed, and insight, all of which are better served by AI-powered tools.

While Google is still a valuable general tool, it is no longer cutting it in the specialized world of private equity, investment banking, and M&A, and that’s why it’s time to trade up to tools that are designed to deliver highly focused, actionable insights. Google’s search algorithms are engineered to serve a wide array of users. Type in “investment opportunities,” and you’ll be bombarded with everything from financial news articles to blog posts and irrelevant ads. The search results are broad, often overwhelming, and in need of significant filtering to extract meaningful information.

In contrast, AI-powered tools like Cyndx’s Finder, are designed to hone in on exactly what you’re looking for. These tools use advanced algorithms and data analytics to analyze and filter data with pinpoint accuracy. Want to find companies in a specific sector with particular financial metrics? AI tools can deliver exactly that – saving you time and effort by presenting the most relevant results.

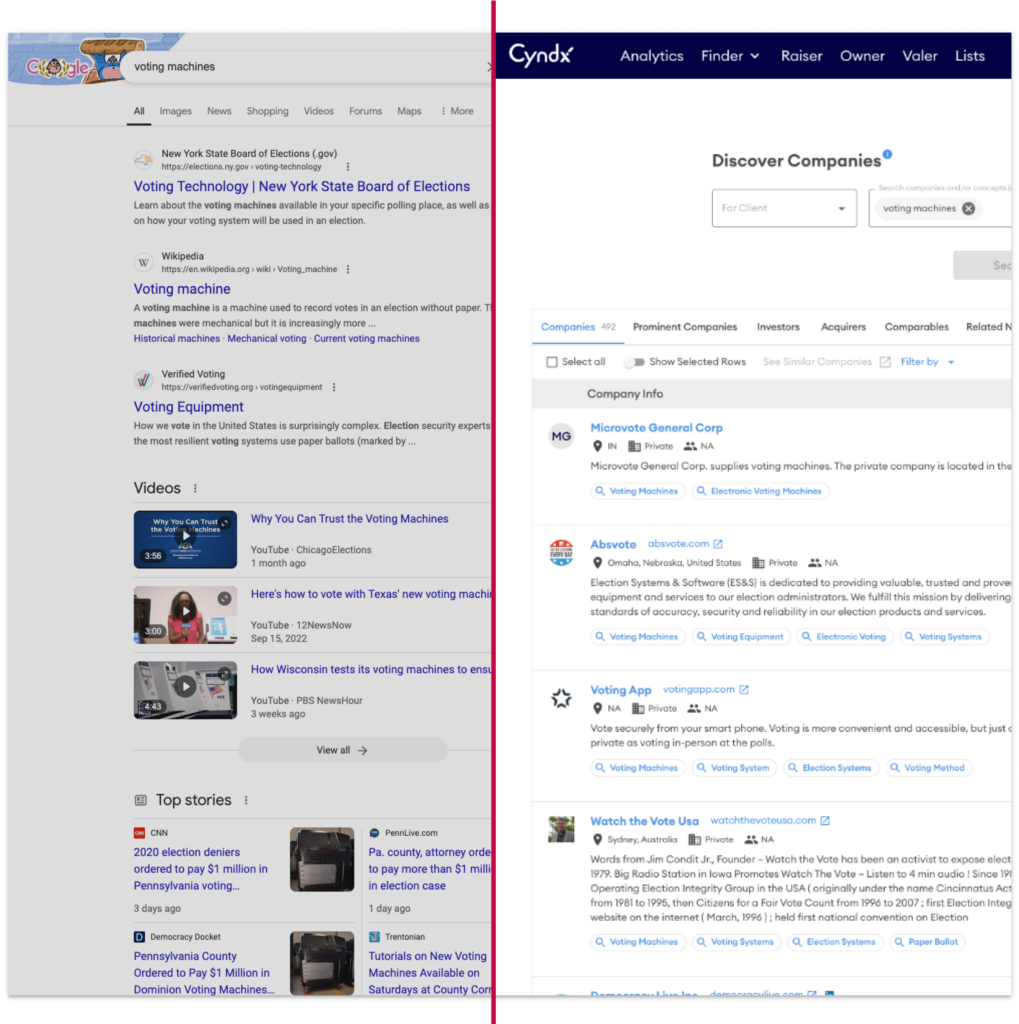

As a test, we ran the keyword “voting machines” on both Google and Finder to see what information each would yield. Here’s the comparison:

Search results for “voting machines” on Google vs Finder.

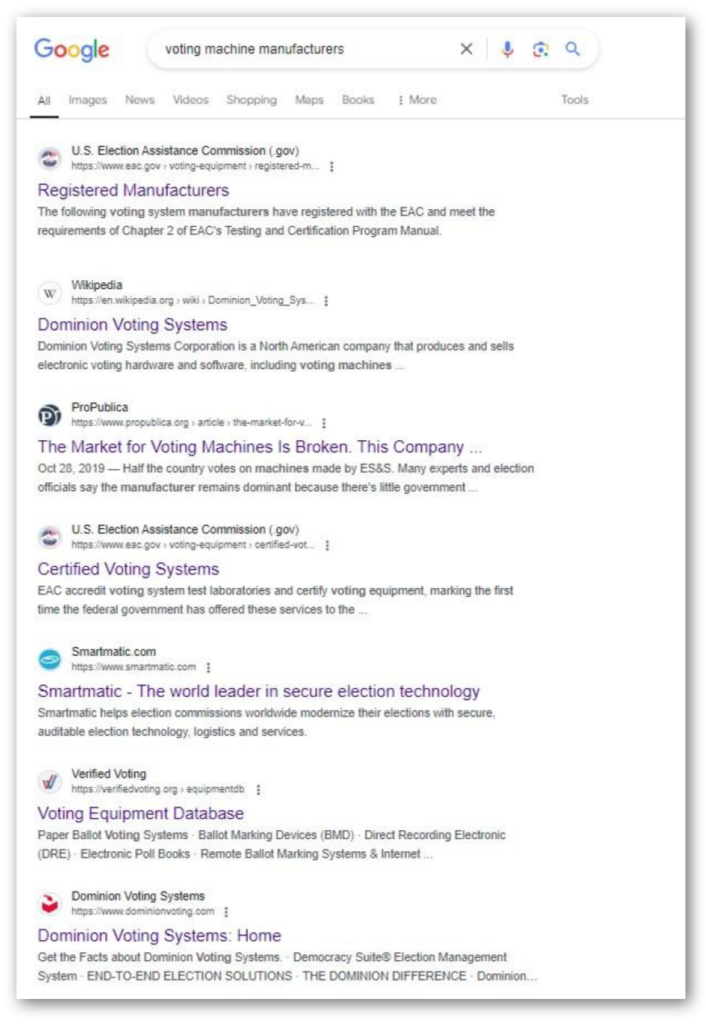

To approximate the Finder results on Google, we had to modify our search term to “voting machine manufacturers”.

How Finder Outperforms Search Engines

The difference in the search results between using search engines and Finder is like night and day. While Google gives us the basics on voting machines, Finder digs deeper with not just related news on the topic, but neatly curated information that truly matters to investors, such as the names of prominent companies operating in the space, names of investors, acquirers, and even comps. What’s more is that the results can be narrowed down geographically – from continent to county, state, town, down to a 250-square-mile radius.

We clicked on the profile of Atlanta-based company Trust Stamp, and Finder delivered an in-depth look at the company’s entire portfolio, covering everything from its portfolio of companies, relationships, upcoming events, SEC filing, and financial report. We also found charts, graphs and maps, fundraising history, and an extensive listing of contact information.

The screenshots show only three of these tabs, yet the cache of detailed and actionable information makes Finder a vital resource for investors seeking in-depth, accurate, and useful data delivered in a neat, curated package.

Finder profile for elections technology company Trust Stamp.

Data Integration

Google is exceptional at indexing web pages but not built for integrating data for deep financial analysis. When you search for deal opportunities, you’ll likely need to pull information from multiple sources – financial reports, market analyses, and news updates – just to get a complete picture.

AI-powered tools integrate data from a variety of sources, including financial statements, market research, and timely company news updates. Tools like Finder provide a holistic view of potential investments, making it easier to perform comprehensive analyses and informed decision-making.

Advanced Analytics

Search engines are adept at providing historical data but fall short in predictive analytics. They can tell you what has happened but don’t offer tools for forecasting future performance or trends.

AI deal-sourcing tools leverage advanced algorithms for predictive modeling. They analyze historical data alongside various factors to forecast future performance. This capability allows you to anticipate market movements and make strategic decisions based on future projections, rather than just past data.

Enhanced Due Diligence

Due diligence in deal sourcing requires thorough research and detailed analysis, far beyond what a general search engine can provide. You need in-depth financial evaluations, risk assessments, and strategic fit analyses.

AI-powered tools streamline due diligence with detailed reports, risk models, and comprehensive data analyses. These tools are tailored for financial professionals, ensuring that you can perform thorough and informed evaluations with ease. This reduces the risk of unexpected issues and enhances the overall efficiency of your due diligence process.

Designed for Financial Professionals

Google’s interface is user-friendly for general searches but lacks the specialized features needed by financial professionals. Finder is designed with the needs of dealmakers in mind, offering streamlined dashboards and intuitive navigation for complex data.

Our tools consolidate key metrics, visualizations, and detailed reports into a single, easy-to-use interface. AI tools make the deal-sourcing process more efficient and allow you to focus on strategy rather than data gathering.

Embracing the AI Advantage

While search engines are a versatile tool for general information, it’s no longer the optimal choice for deal sourcing in the competitive realms of private equity, investment banking, and M&A. AI-powered tools offer precision, tailored intelligence, real-time insights, and advanced analytics that search engines simply cannot provide.

If Google is still your go-to for sourcing deals, it’s time to reconsider your strategy. Embracing AI-powered tools like Finder will not only be efficient but also provide a significant edge in identifying and capitalizing on investment opportunities.

For investors seeking precision, comprehensive data, and actionable insights, Finder is not just a handy tool to have in your deal-sourcing arsenal; it might be the only tool you’ll ever need.

Interested in learning more? Get in touch.