In early 2020, analysts and investors tracking Tesla’s cash flow, debt structure, and rapid stock price appreciation predicted a capital raise. When Tesla announced a $5 billion stock offering in September, those who positioned early benefited from the post-raise price rally. This kind of foresight — seeing capital events before they happen — is invaluable in the world of venture capital, private equity, and investment banking.

Today, predictive analytics is making investment insights more accessible. Powered by AI, our Projected to Raise (P2R) tool can anticipate which companies are on the verge of raising capital, helping investors act ahead of the market. This AI-driven system doesn’t just identify companies that might need capital; it forecasts companies that are most likely to raise within six months, based on hard data, proprietary algorithms and historical patterns.

P2R is a sophisticated machine learning pipeline that analyzes a vast array of historical funding data and company attributes, identifying patterns that signal an imminent fundraising event. By leveraging Cyndx’s extensive data ecosystem, we assign probabilities to companies based on their similarity to previously successful fundraisers.

This data pipeline is built on advanced engineering principles, pulling insights from structured datasets that track investment patterns, funding round details, and macroeconomic factors. The system filters out noise and irrelevant data points, refining its predictions to focus on the most likely candidates. The result: actionable intelligence that allows investors to stay ahead.

For PE firms, venture capitalists, and strategic acquirers, our predictive analytics tool functions as a radar system — scanning the market and highlighting companies poised for financial activity before they become widely known.

But predictions are only as good as their results. Let’s look at five recent fundraising events that we predicted before they made the news. These cases underscore how machine learning is redefining capital raising intelligence and giving investors a valuable edge.

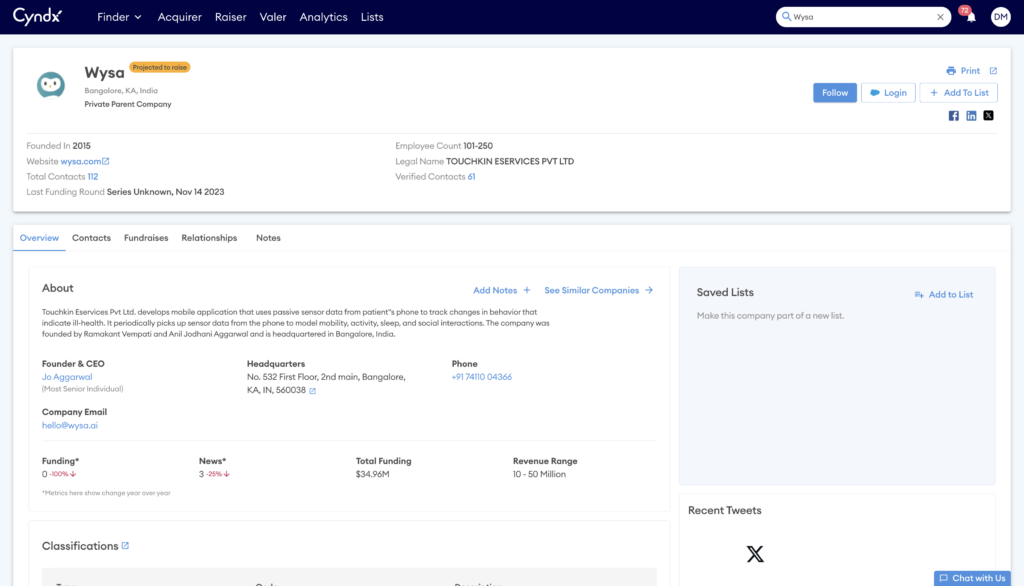

1. Wysa and April Health Merge

Mental health startups have been riding a wave of investment, but not all deals are easy to spot. The merger between AI-driven therapy platform Wysa and behavioral health innovator April Health was a strategic move to expand access through primary care networks.

Our algorithm identified both companies as likely candidates for a major transaction, tracking funding momentum in the digital health space, employee growth patterns, and investor activity. The deal, which strengthens AI’s role in mental healthcare, proves that predictive analytics can spot not just fundraising rounds, but also M&A moves that signal industry shifts.

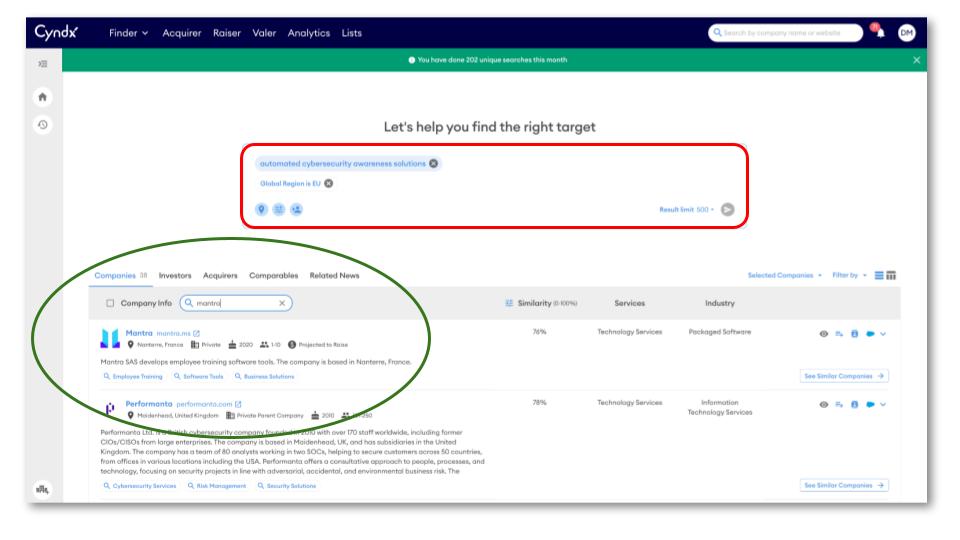

2. Cyber Guru and Mantra

In an era where cyber threats evolve daily, cybersecurity awareness training is a critical investment area. Our predictive analytics flagged both Cyber Guru and Mantra as companies on the verge of raising capital, noting increased demand for security education and heightened investor interest in AI-driven training platforms.

When these two companies announced their merger, it wasn’t just about scale — it was about meeting an urgent market need with combined expertise. By monitoring industry-wide capital flows and funding cadence, we picked up on the signals that led to this deal before it was made public.

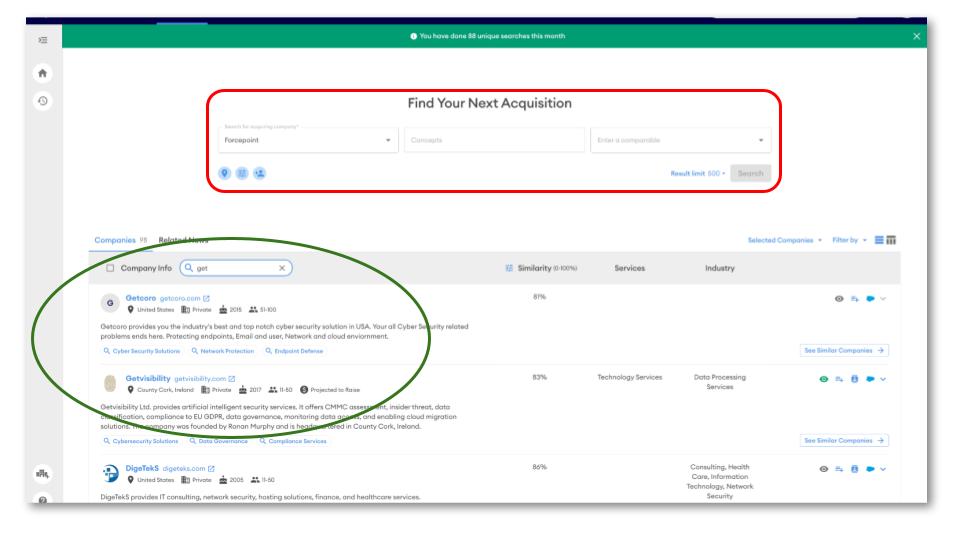

3. Forcepoint Acquires Getvisibility

Forcepoint’s acquisition of Getvisibility didn’t come out of nowhere — at least not to those using our platform. We identified Getvisibility as a strong candidate for fundraising or acquisition based on recent rounds of funding, market interest in AI-driven data security, and Forcepoint’s own strategic moves in the sector.

This prediction highlights another key advantage — not only identifying who might raise but also which companies are primed for exits. For investors, understanding these patterns means staying ahead of industry consolidation rather than reacting to it.

4. Accenture Acquires and Altus Consulting

Accenture’s acquisition of Altus Consulting was a strategic play to enhance its capabilities in insurance and investment consulting in the United Kingdom. P2R flagged Altus as a likely fundraising candidate, based on its growth trajectory, industry trends, and investor interest in fintech and digital transformation.

Rather than raising fresh capital, Altus took the acquisition route — a prime example of how predictive analytics can anticipate capital events beyond traditional funding rounds. For dealmakers, knowing which companies are on the cusp of major transactions means being ready to move before the competition.

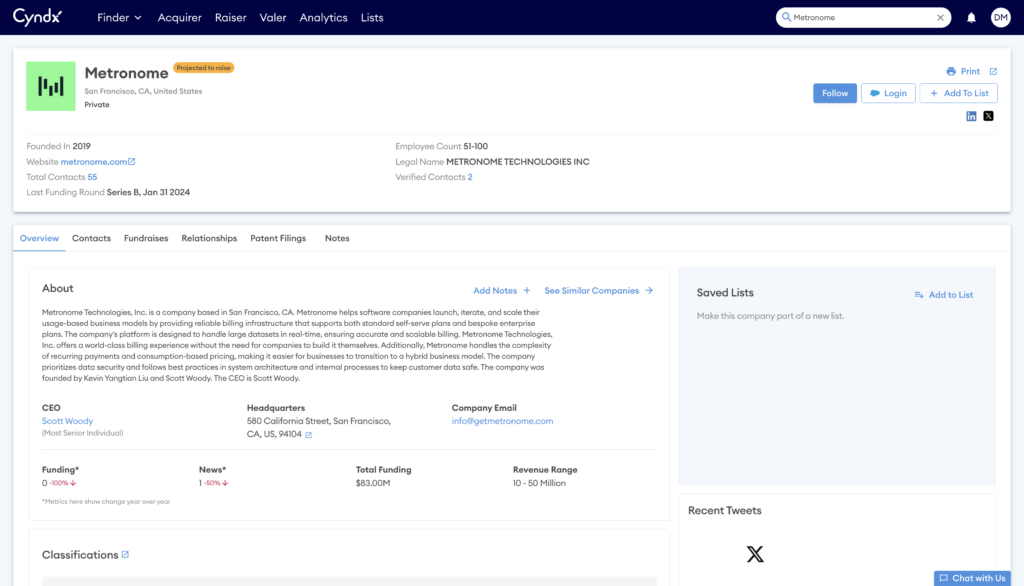

5. Metronome’s $50M Series C

Usage-based pricing is transforming software monetization, and Metronome is at the forefront. Our machine learning models identified the software-as-a-service (SaaS) company as a top contender for a significant raise.

How Predictive Analytics Helps Investors

These five cases aren’t just proof of concept — they demonstrate the future of deal sourcing. Traditional research methods can be time-consuming and reactive, but machine learning tools like “predicted to raise” provide a proactive edge. Whether identifying companies likely to raise capital, spotting M&A trends,or predicting industry shifts, predictive analytics is becoming an indispensable tool for investors.

This machine learning model continuously refines itself by processing market data. At the start of the week, the system ingests new data points, recalculates probabilities, and updates its list of projected fundraising candidates. This allows investors and financial professionals to move quickly, engage with potential investment targets earlier, and maximize deal flow efficiency.

Beyond individual deals, our predictive analytics also helps investors identify macro trends. Are AI-driven cybersecurity startups attracting capital at an accelerating pace? Is the healthcare sector’s interest in predictive analytics peaking? By aggregating and analyzing thousands of data points, P2R offers a window into where capital is flowing and why.

The Future of Predictive Fundraising

The rise of AI-powered fundraising predictions isn’t just a trend but a paradigm shift in how capital markets function. As more investors embrace these tools, the competitive edge will belong to those who act on data before it becomes common knowledge. Predictive analytics is no longer optional — it’s an essential tool for those who wish to thrive in a world where speed and insight define success.

Keep an eye on this space — we’re working on our predictive analytics every day and making big changes. Expect to see some new predictive features added in the near future.

Interested in learning more? Let’s talk.