In the never-ending battle against weight gain, consumers have cycled through every imaginable solution — from cabbage soup diets to high-tech fitness trackers. But nothing has shifted the landscape quite like GLP-1 medications, the blockbuster drugs reshaping not only waistlines but entire industries. As appetite-suppressing effects ripple through the market, major corporations are reevaluating their portfolios, divesting from once-lucrative product lines, and doubling down on wellness. For dealmakers, the rise of these medications has opened a new chapter of M&A activity, from food and beverage to healthcare and insurance.

What Are GLP-1 Medications?

GLP-1 stands for glucagon-like peptide-1, a hormone that helps regulate blood sugar levels and appetite. Initially developed to manage type 2 diabetes, GLP-1 receptor agonists, including semaglutide (marketed as Ozempic and Wegovy) and tirzepatide (Mounjaro and Zepbound) have since gained prominence as powerful weight-loss drugs. These medications mimic the GLP-1 hormone, which regulates blood sugar and slows digestion, leading to reduced appetite and significant weight loss. With prescriptions soaring, the drugs have not only transformed personal health but have also forced corporations to rethink how they cater to a population consuming fewer calories and prioritizing metabolic health.

Decline of Traditional Snacks and Alcohol

As GLP-1 use rises, consumers report decreased cravings for high-calorie snacks and alcohol, directly impacting food and beverage giants. PepsiCo and Mondelez International, both deeply entrenched in the snack industry, have witnessed shifts in their product portfolios and are actively adjusting their strategies. PepsiCo, home to Lay’s and Doritos, has seen growth stagnate in its traditional snack lines, leading the company to expand its offerings in the “Better For You” category, focusing on high-protein, fiber-rich snacks with functional health benefits. Mondelez, the maker of Oreos and Chips Ahoy, has responded by acquiring health-focused brands like Hu Products, a premium clean-label snack company, to capture the growing segment of consumers seeking simple, whole-food ingredients.

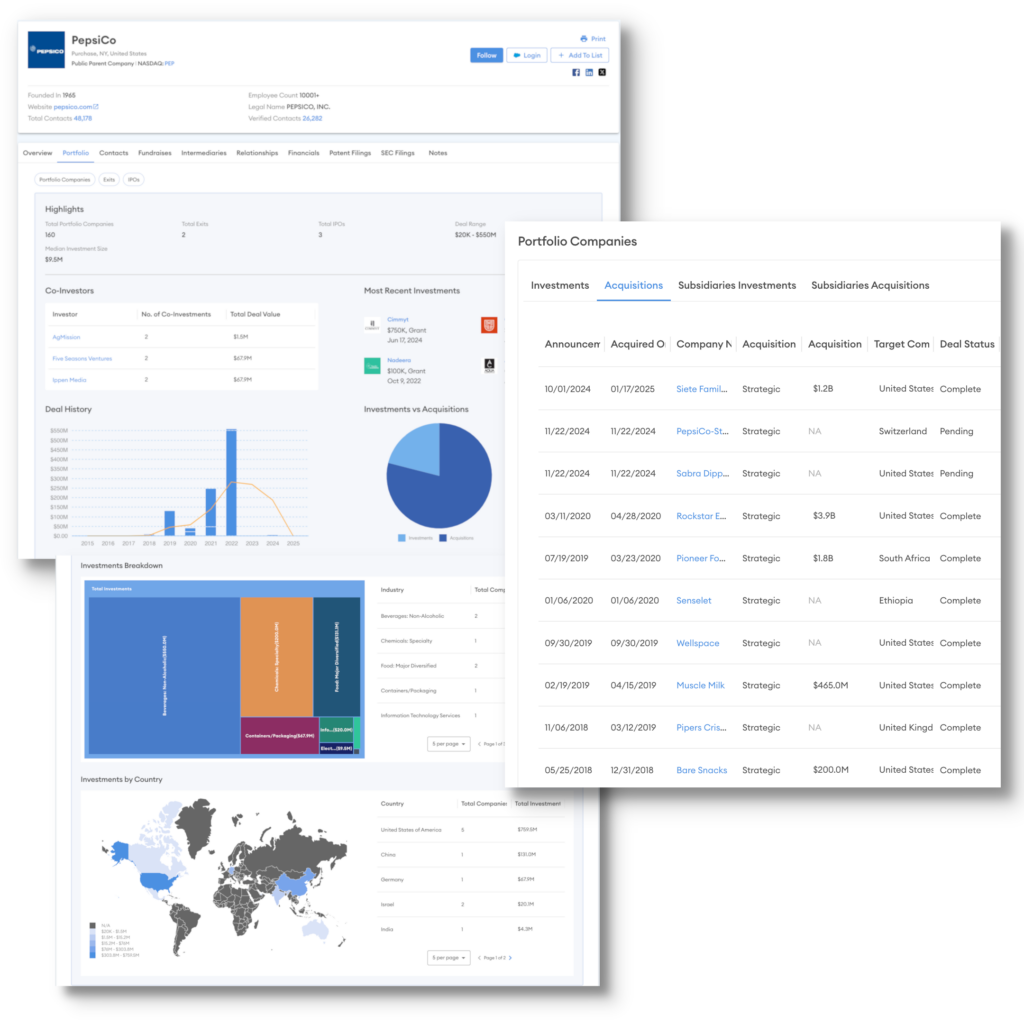

Pepsico’s Finder profile shows the company’s recent acquisitions

The beverage sector is experiencing a similar shift, particularly in alcohol consumption. Reports indicate that GLP-1 users often reduce or eliminate alcohol intake due to changes in taste perception and sensitivity to alcohol’s effects. This has led to declining sales in beer and spirits, prompting brands to innovate. Companies like Anheuser-Busch and Diageo are investing more heavily in non-alcoholic and functional beverage alternatives, including hop-infused waters and adaptogenic drinks, in an attempt to retain market share in an increasingly health-conscious environment.

Growth in Wellness-Focused Brands

As traditional snack and beverage sales decline, the market for functional foods, protein-packed products, and wellness brands is experiencing unprecedented growth. Coca-Cola, recognizing this shift early, has aggressively expanded its portfolio by acquiring Fairlife, a high-protein milk brand. Fairlife’s ultrafiltered, lactose-free dairy products provide high-protein, low-sugar options that cater to fitness enthusiasts and GLP-1 users seeking to maintain muscle mass while losing weight.

Other beverage and food giants have followed suit. Nestlé Health Science has acquired a majority stake in Orgain, a leader in organic protein products. Orgain’s protein shakes, powders, and bars align with the rise of meal replacements and functional nutrition, allowing Nestlé to secure its foothold in the booming health and wellness sector. The Swiss food and drink conglomerate has also acquired brands such as Vital Proteins, capitalizing on the demand for collagen-based wellness products.

Meanwhile, Unilever has expanded into plant-based nutrition through its purchase of brands like Liquid I.V., which focuses on hydration and electrolyte balance — key concerns for consumers on appetite-suppressing medications. The race is on for companies to hedge against declining demand for traditional junk food by investing in nutrition-forward brands that align with evolving consumer behavior.

Medical Distribution, Devices, and Insurance Implications

The rise of GLP-1 medications isn’t just altering the food landscape — it’s driving increased demand in healthcare infrastructure, medical devices, and insurance. With more consumers seeking prescriptions, pharmaceutical companies are scaling up manufacturing and distribution capabilities. Companies like Novo Nordisk and Eli Lilly, the leading producers of GLP-1 drugs, are expanding production facilities and striking strategic partnerships with pharmacy benefit managers to ensure widespread availability.

At the same time, the medical device industry is adapting to serve this new wave of patients. Continuous glucose monitors (CGMs) and metabolic tracking devices, originally designed for diabetics, are seeing broader adoption among non-diabetic users who want to optimize their metabolic health while on GLP-1 treatments. Companies like Abbott and Dexcom are capitalizing on this shift by marketing CGMs as general wellness tools, leading to increased sales and potential M&A activity in the wearable health tech space.

Health insurers, meanwhile, are facing mounting pressure to cover GLP-1 drugs given their profound impact on obesity-related conditions. While some insurers initially balked at the costs, the long-term savings from reduced rates of diabetes, heart disease, and other chronic conditions have made the case for broader coverage more compelling. This has led to potential acquisitions of digital health startups that offer weight management programs tailored to GLP-1 users.

Major Players Hedging Against Changing Consumer Behaviors

The most forward-thinking corporations are treating the rise of GLP-1 medications not as a threat but as an opportunity. As consumer habits shift, companies are hedging against declining sales in traditional product lines by acquiring health-conscious brands and diversifying their offerings. PepsiCo has been expanding its portfolio with functional beverages and high-protein snacks, while Mondelez is positioning itself as a leader in “permissible indulgence” by investing in lower-sugar and higher-protein snack alternatives.

Even fast-food giants are adapting. McDonald’s, for example, has been testing leaner menu options, while chains like Chipotle and Sweetgreen are seeing increased investor interest due to their alignment with health-conscious eating trends. The broader foodservice industry is being forced to reconsider menu offerings, with some companies exploring partnerships with nutrition brands to provide GLP-1-friendly meals.

Game-Changing Tools for Deal Sourcing

For investment bankers, private equity executives, and venture capital investors focused on healthcare and wellness, Cyndx’s Acquirer and Finder platforms are true game-changers. These AI-driven M&A intelligence tools enable dealmakers to swiftly identify high-potential acquisition targets in the rapidly evolving GLP-1-driven market. With quick data analysis, Acquirer surfaces emerging wellness brands, medical technology firms, and healthcare service providers poised for growth, helping investors stay ahead of shifting consumer and industry trends.

Moreover, Acquirer streamlines due diligence by offering deep insights into a target company’s financials, competitive positioning, and market trajectory. For PE and VC firms navigating the surge in GLP-1-related opportunities, this means faster, data-backed decision-making and a higher probability of securing valuable assets before competitors.

As healthcare, insurance, and food conglomerates reposition for the future, Acquirer ensures investors are equipped to capitalize on the next big wave of industry transformation.

The New Frontier for Wellness M&A

For investors and dealmakers, the ripple effects of GLP-1 medications present a dynamic landscape for M&A. As legacy food brands pivot, expect continued consolidation in the health and wellness space, with strategic acquisitions of protein-forward, functional, and low-sugar product lines. Meanwhile, healthcare investments are likely to accelerate, with increased funding for medical technology, pharmaceutical innovation, and digital health platforms supporting metabolic health management.

This shifting market isn’t just about divestitures and acquisitions — it’s about future-proofing. Investors who recognize the impact of GLP-1 medications on consumer behavior will thrive, while those slow to adjust risk being left behind. The main takeaway is that the next phase of M&A in the healthcare and wellness market will be defined by this seismic shift in how people eat, drink, and manage their health.

As the saying goes, “Nourish to Flourish!” And for dealmakers riding the GLP-1 wave, it’s not just health that’s flourishing. While waistlines shrink, market opportunities are only getting bigger. That is, if you have the right AI tools.