There’s an old saying in the world of finance: “Know the value of what you own, or someone else will.” In other words, the secret to success in any dealmaking situation — whether you’re buying, selling, or investing in a company — is understanding its true worth. Yet, while this may sound like basic Business 101, the reality is that many companies and investors overlook the intricacies of business valuation.

Far from being a theoretical exercise, business valuation, or business appraisal, is the compass that helps navigate the often murky waters of mergers and acquisitions (M&A), partnerships, and financial decision-making. Knowing how to accurately assess a company’s value using the right metrics and tools is essential for maximizing returns, minimizing risk, and avoiding costly mistakes. And with new technologies like AI-powered valuation tools entering the market, doing so has never been easier — or faster.

Understanding Valuation Multiples

At the core of business valuation lies the concept of multiples. A valuation multiple is a financial metric used to assess the value of a business in relation to some key financial indicator — typically earnings, sales, or assets. These painstakingly collated datasets, which would traditionally take months to piece together, act as shortcuts, enabling investors to quickly compare companies in the same industry and derive a company’s worth without the deep-dive analysis of every financial statement.

The two most commonly used valuation multiples are Enterprise Value to EBITDA (EV/EBITDA) and Price to Earnings (P/E) ratios. The first, EV/EBITDA, is a measure of a company’s total value (enterprise value) compared to its earnings before interest, taxes, depreciation, and amortization (EBITDA), giving investors insight into the operating profitability of a business. The second, P/E ratio, compares a company’s share price to its earnings per share (EPS), making it a useful indicator for assessing the relative value of a publicly traded company.

Each industry and company type will require a different approach when it comes to valuation multiples. For example, technology companies often rely on revenue multiples due to their growth potential, while companies in more stable sectors such as utilities may rely on P/E ratios for their predictable earnings streams. Knowing which multiples to use, and when, can significantly impact the accuracy and reliability of your valuation.

Advantages and Limitations of Valuation Multiples

Valuation multiples provide an efficient and scalable way to assess a company’s worth. They are especially useful when investors are comparing multiple companies within the same industry, providing an instant snapshot of where a company stands relative to its peers. Additionally, they can serve as benchmarks when determining appropriate pricing for mergers and acquisitions, guiding sellers on how to position their business for sale or buyers on what price point would be reasonable.

However, valuation multiples are not without their limitations. The wrong tools tend to oversimplify a company’s financial situation and don’t always account for underlying risks, such as debt levels or changing market conditions. Furthermore, these multiples can fluctuate depending on macroeconomic factors or industry-specific trends, meaning they need to be interpreted with care and in the context of broader market conditions. For instance, the EV/EBITDA multiple might be skewed in a rapidly growing industry where investors are willing to pay a premium for future growth, but that same multiple might not be appropriate for a company in a mature industry facing stagnation.

Optimizing Business Valuation Multiples

While valuation multiples can provide a good starting point, the best way to optimize business valuation is to consider multiple methods of evaluation. A combination of approaches offers a more robust analysis, accounting for varying factors and providing a fuller picture of a company’s worth. Some investors may prefer to start with a market-based valuation (using multiples like EV/EBITDA or P/E) and then complement that with a more detailed financial model like the Discounted Cash Flow (DCF) analysis.

Additionally, investors should look for opportunities to improve key business metrics that drive these multiples. For example, if a company has a low EV/EBITDA multiple, it could mean its operating profitability is below that of its peers. In this case, boosting efficiency, reducing debt, or increasing margins could help the business achieve a higher valuation multiple and attract more buyers or investors.

Industry Applications of Business Valuation Multiples

Valuation multiples can be applied across all industries, but the way they are used and interpreted differs significantly from sector to sector. Let’s take a look at a few industries where valuation multiples play an important role:

- Tech Industry: Technology companies, especially startups and growth-stage businesses, often use revenue multiples due to the emphasis on growth over immediate profitability. For example, SaaS (Software as a Service) companies are often valued on their annual recurring revenue (ARR) rather than EBITDA.

- Healthcare: Healthcare businesses, especially those in pharmaceuticals and medical devices, may be valued based on P/E or EV/EBITDA ratios, but also factors like pipeline strength, intellectual property, and regulatory hurdles come into play.

- Manufacturing: Manufacturing companies are often evaluated using EV/EBITDA or asset-based multiples, with the emphasis on their ability to produce tangible goods at scale while managing operating costs efficiently.

Understanding these nuances across different sectors is key for any investor looking to make informed decisions and optimize their own valuation multiples for the greatest return.

How Cyndx’s Business Valuation Platform Stands Out From Others

We’ve established the significance of valuation multiples, but how can dealmakers and investors leverage the best ones to their advantage? That’s where Cyndx’s business valuation platform, Valer, comes in.

The AI-powered valuation tool is the only one of its kind that can provide instantaneous, data-driven insights into the value of any business — whether you’re on the buy or sell side.

Using a variety of proven methodologies, Valer can generate detailed, customized valuation reports in a fraction of the time it would take using traditional methods. Our clients are thrilled with the tool, the time saved, and how quickly it processes information.

Here’s how it works:

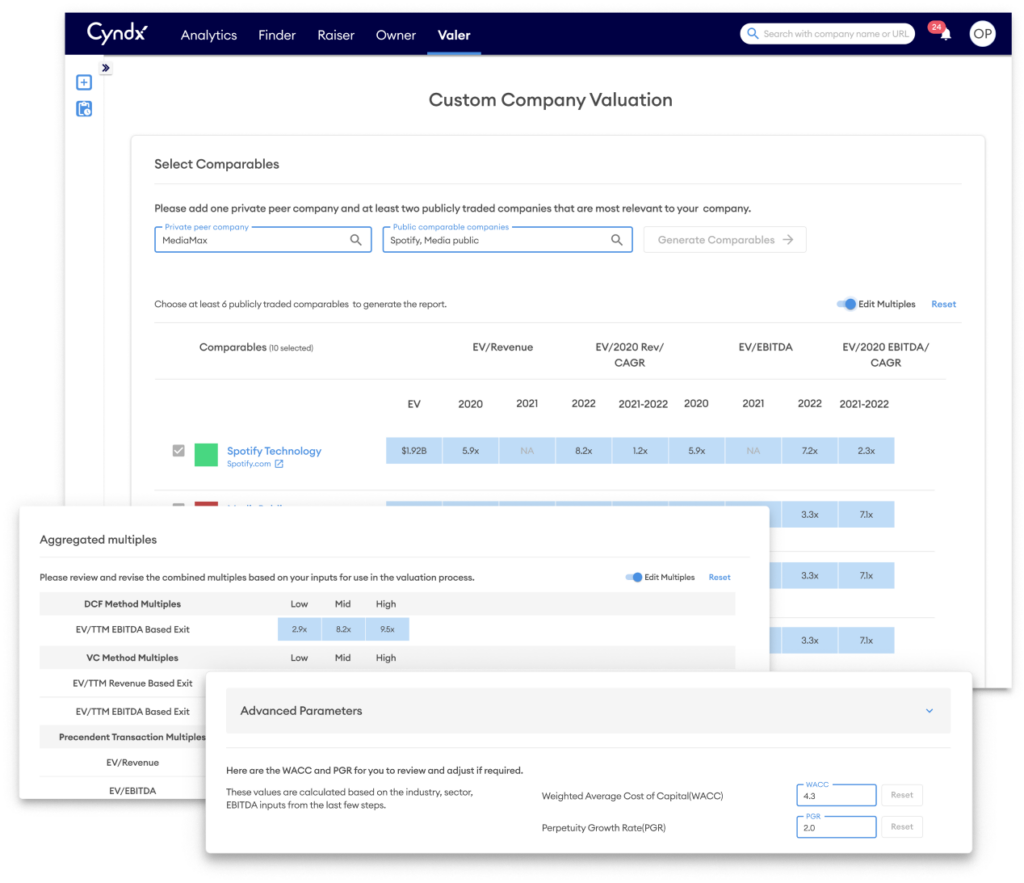

- Discounted Cash Flow (DCF) Analysis: Valer leverages DCF analysis to calculate the present value of future projected cash flows. This methodology is essential for understanding the long-term health of a company, making it perfect for any investors who want to predict future performance based on expected cash generation. Users have the ability to adjust factors such as WACC, PGR, and comp multiples to refine the valuation analysis and nuances as needed.

- Public Company Comparables: It generates comparisons to publicly traded companies, offering investors a quick view of how a company stacks up against its peers. With real-time data and customizable filters, you can find the exact benchmarks you need to accurately gauge a company’s market value.

- Precedent Transaction Analysis: The platform also applies precedent transaction analysis, comparing historical transaction multiples from similar businesses to determine a company’s potential market price.

- Future Value Method: For startups or companies with high growth potential, the Future Value Method within Valer can predict a business’s value in the future, accounting for potential exit scenarios, such as IPOs or acquisitions.

One of the biggest advantages of using Valer is its speed. Rather than waiting days or weeks for a comprehensive report, investors can receive an in-depth analysis in mere seconds, with the option to customize data sets and parameters based on specific needs.

Additionally, Valer provides a visually rich, intuitive interface that enables investors to clearly understand how a company compares to public or private industry competitors, making it an essential tool for anyone navigating complex M&A deals.

Indispensable Investment Tool

Business valuation multiples are an indispensable tool for investors, but they’re not the be-all and end-all. Optimizing these metrics, applying the right methodologies, and combining them with new technologies like AI-powered platforms can help uncover hidden value and create smarter, more profitable deals. With dealmaking getting more and more tech-intensive and competitive, having access to real-time, data-driven valuation insights has never been more important. With Valer, you can streamline your valuation process, save valuable time, and enhance your decision-making power.

So, the next time you’re faced with a valuation, why not try our tools? Remember, speed is everything in a deal and our valuation tool provides detailed reports in minutes. The right tools can make all the difference in an increasingly fast-paced world.