Curate a better deal pipeline

Plenty of platforms claim to help you build a differentiated, proprietary deal pipeline. Cyndx helps you identify those hard-to-find companies that represent the most relevant deal opportunities — the companies you’ve never heard of, but need to know. The size of our database and strict quality standard mean you get actionable data insights in one search — no weeding out false positives or struggling to collect prospects from a fragmented market.

AI-Driven Sourcing

Identify relevant acquisition targets.

Superior Coverage

Map global markets in seconds.

Actionable Insights

Spot high-value private companies.

Access company data fast.

Cyndx Finder gives you access to more opportunities than anyone else. Search from over 30M+ companies. Filter your search by funding stage, location, financials, and more to find the most relevant companies for your investment strategy.

Explore and map fragmented markets.

Cyndx uses AI and NLP to dynamically map companies by what they do and how they describe themselves. Dynamic categorizations reflect fresh data imported on a daily basis, and capture the true extent of a business product or service — making it easy to build lists of private companies for any sector, including niche, emerging, and intersecting verticals.

See up-to-date,

verified data.

Cyndx uses machine learning to derive the most credible insights, starting from the company’s website. We are always on the lookout for new information, so you will always be the first to know when a company updates its information.

Search options for any strategy.

Growth capital, leveraged buyouts, mezzanine financing — whatever your fund’s focus, Cyndx offers a range of customizable search options to fit your sourcing needs. Create lists of lookalike companies, map companies with similar patent holdings, search by technical term or industry jargon, sort by funding stage, and more.

Identify investment opportunities which truly match your mandate.

Identify emerging sectors and pinpoint the most relevant investment and acquisition opportunities.

Make CRM data more actionable and integrate with Cyndx to get more from your institutional knowledge.

Enhance team efficiency by list-making, linking, and tagging for easy collaboration.

Help portfolio companies grow by tracking cap tables, storing diligence documents, and finding the right potential acquirers, all with one tool.

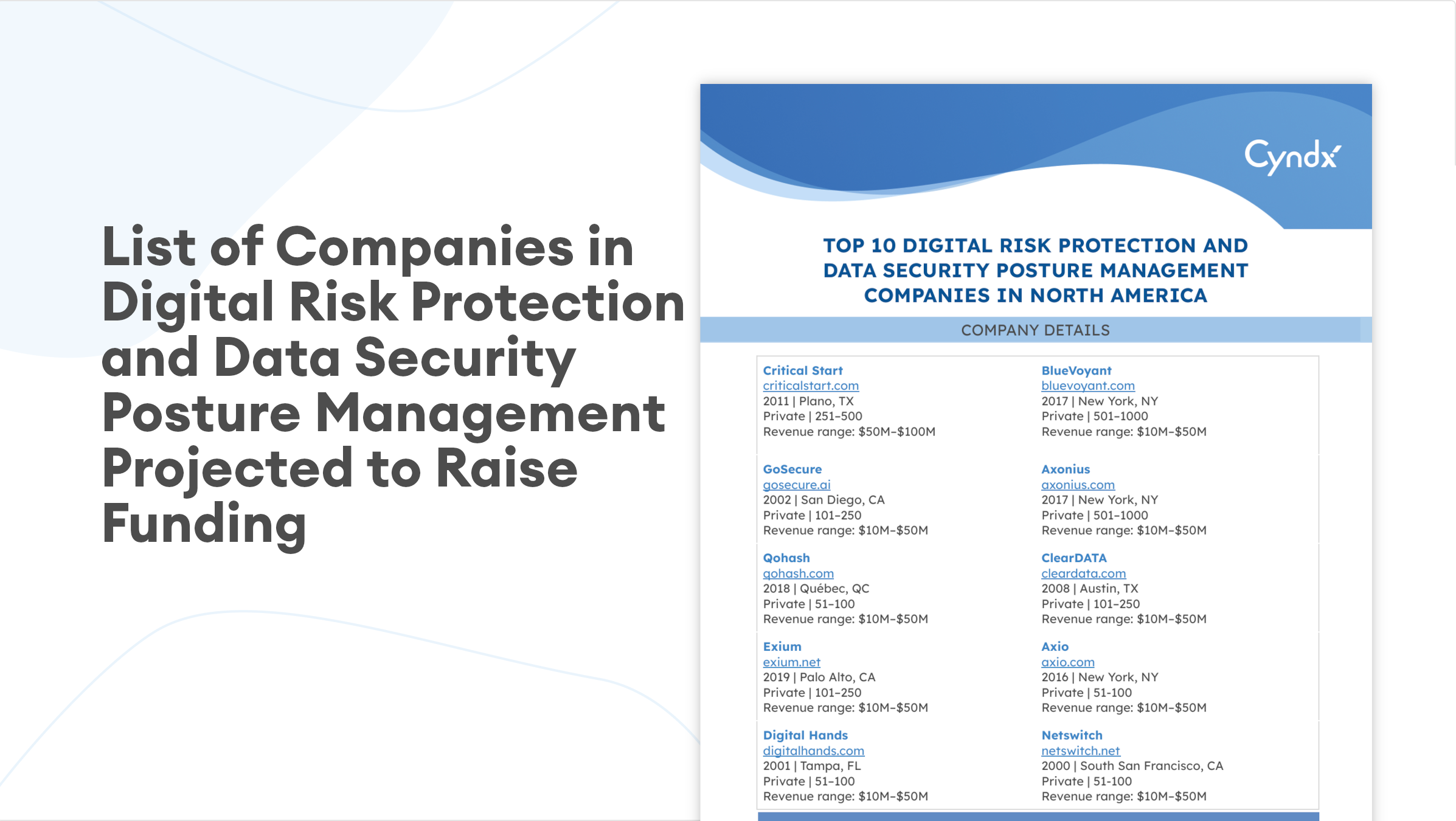

Identify companies projected to raise capital within the next six months.

Set accurate valuations with trading multiples from the closest public comparables.

Explore our resources.

Learn more about what’s happening in the market right now that can help

your business grow.