Each spring, as tulips bloom and grocery aisles go pastel, America’s sweet tooth kicks into overdrive. Easter candies — those neon marshmallows, chocolate bunnies, and kaleidoscopic jelly beans — aren’t just childhood nostalgia; they’re also a seasonal juggernaut. In 2024, U.S. confectioneries raked in over $5 billion in Easter-related sales, according to the National Confectioners Association. That’s not just sugar rush economics — it’s a high-margin, brand-driven phenomenon tailor-made for M&A opportunities.

Easter is second only to Halloween in seasonal candy sales, but its growth has proven more resilient. While Halloween is frightfully reliant on trick-or-treating turnout, Easter’s appeal is rooted in tradition and merchandising genius. Think Peeps, the divisive marshmallow treats that somehow maintain cult status and licensed spin-offs. The category’s core strengths? Low spoilage, built-in annual demand, and relentless innovation in packaging and flavor.

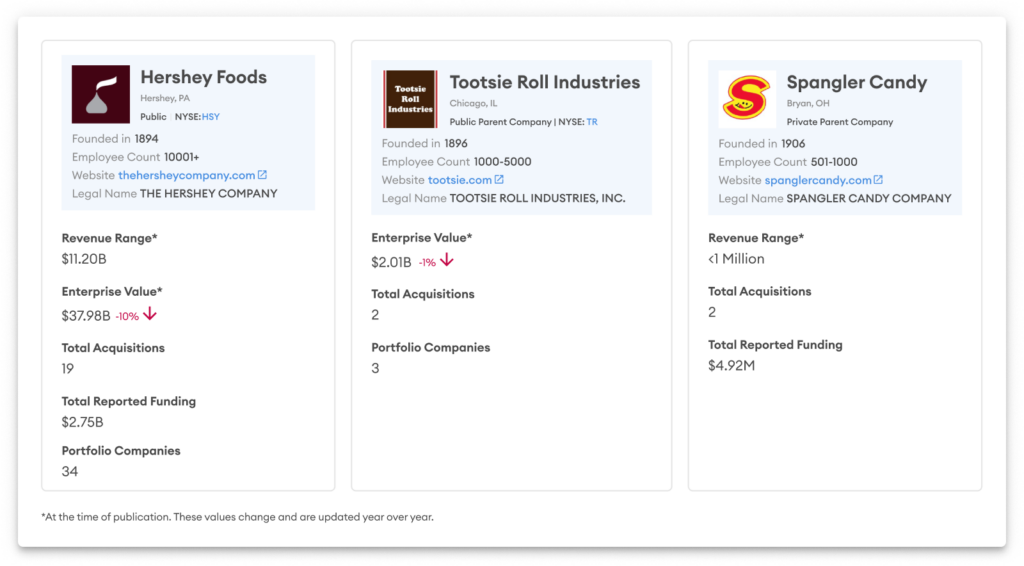

For dealmaking investors, it’s a case study in durable consumer demand. From privately held gems like Just Born, the maker of Peeps, to public stalwarts like Hershey and Tootsie Roll, the Easter season reveals who can truly capitalize on fleeting windows of consumer attention. Add to that a healthy appetite for nostalgia and a growing trend towards artisanal treats, and you’ve got fertile ground for strategic investment or roll-up plays.

With consumer-packaged goods giants and private equity firms sniffing around seasonal best-sellers, the Easter aisle might just be the sweetest corner of your portfolio. Using Finder, our AI-powered deal origination tool, let’s unwrap the companies at the top.

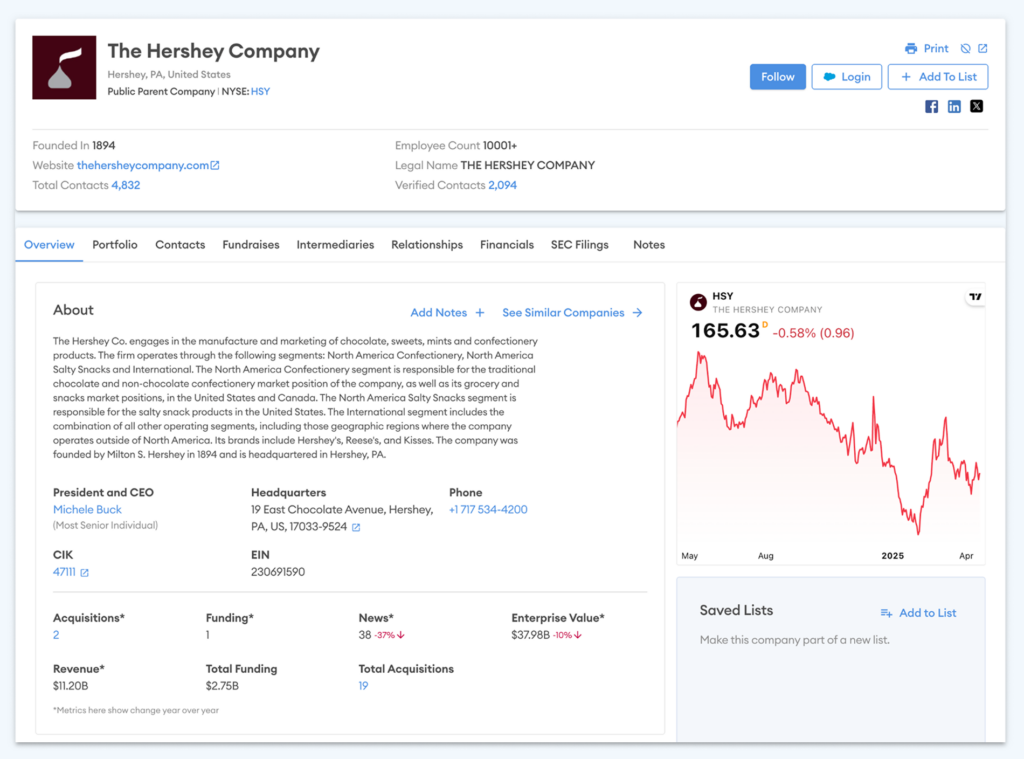

The Hershey Company (Hershey, PA)

Easter Brands: Reese’s Eggs, Cadbury Creme Eggs (U.S. license), Hershey’s Kisses, Milk Chocolate Bunnies

Financials:

- Revenue: $11.2 billion

- Net Income: $2.22 billion

- Enterprise Value: Approximately $37.98 billion

Founded in 1894 by Milton S. Hershey, the company has grown into one of the world’s largest chocolate manufacturers. Despite challenges like rising cocoa prices and shifting consumer preferences, Hershey remains a dominant force in seasonal confections, particularly during Easter. Their strategic focus on expanding their chocolate portfolio and maximizing seasonal strengths positions them well for continued growth.

Just Born, Inc. (Bethlehem, PA)

Easter Brands: Peeps, Mike and Ike (seasonal varieties)

Financials:

- Revenue: Estimated to be above $1 billion

Established in 1923, Just Born is best known for its iconic marshmallow Peeps, a staple in Easter baskets across the U.S. While privately held and smaller in scale, the company’s strong brand recognition and seasonal sales peaks make it an interesting prospect for investors looking to capitalize on niche markets. Here’s a look at the profiles of some of Just Born’s top comparables:

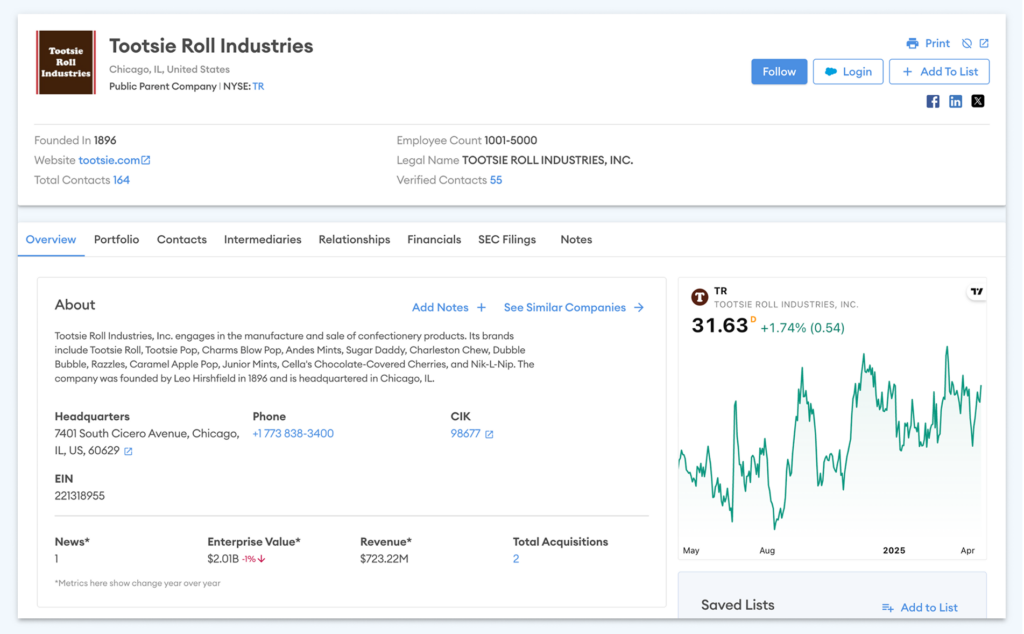

Tootsie Roll Industries (Chicago, IL)

Easter Brands: Tootsie Pops, Dots, Junior Mints, Andes Mints

Financials:

- Revenue: $723.22 million

- Enterprise Value: Approximately $2.01 billion

- Market Cap: Approximately $2.2 billion

With a history dating back to 1896, Tootsie Roll Industries has a diverse portfolio of candies that see seasonal boosts during holidays like Easter. The company is currently investing in expanding its non-chocolate product lines, such as a $97.7 million expansion of its Blow Pop manufacturing facility, to adapt to changing consumer tastes.

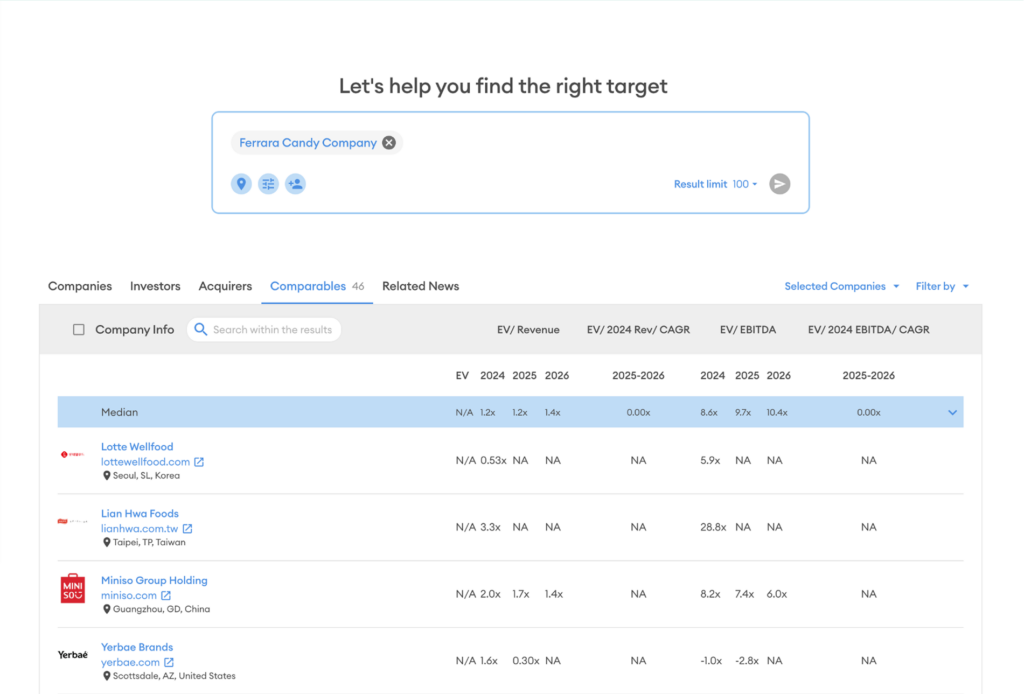

Ferrara Candy Company (Chicago, IL)

Easter Brands: Brach’s Jelly Beans, Nerds Gummy Clusters, Sweetarts

Financials:

- Revenue: $1.8 billion

- Pro-forma Revenue (including acquisitions): Nearly $2.2 billion

A leader in sugar confections, Ferrara has revitalized classic brands like Nerds, whose Gummy Clusters alone achieved $800 million in sales in 2024. Recent acquisitions, including Dori Alimentos and Jelly Belly, have expanded their global footprint, making them a dynamic player in the confectionery market. In 2017, Ferrara itself was acquired by the Ferrero Group, a global confectionery giant known for brands like Nutella and Ferrero Rocher. Here are some of its comps:

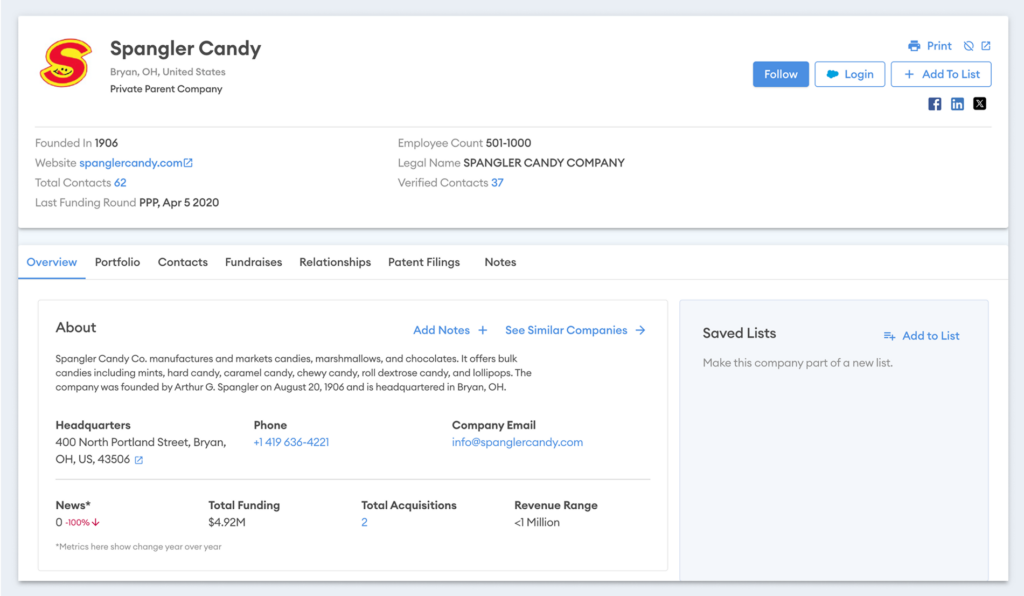

Spangler Candy Company (Bryan, OH)

Easter Brands: Classic Jelly Beans, Circus Peanuts, seasonal Dum-Dums lollipops

Estimated Revenue: Less than $1 million

Family-owned since 1906, Spangler Candy is best known for iconic treats like Dum-Dums, candy canes, and of course, its jelly beans and marshmallow Circus Peanuts—Easter basket staples for generations. While it doesn’t play at the scale of Mars or Hershey, Spangler wins with charm, heritage, and shelf dominance in mid-tier retail.

Easter Deal Hunt

For all the charm of jelly beans and marshmallow chicks, the real treat is identifying which confectionery players are ripe for acquisition, or ready to scale. But seasonal strength doesn’t always show up on spreadsheets, and spotting the right target requires more than a sugar high.

Using advanced AI and machine learning, our Finder platform goes far beyond surface-level filters. It analyzes company trajectories, funding momentum, sector relevance, and growth patterns to uncover high-potential businesses — even those hiding in plain sight. Whether you’re eyeing a legacy brand primed for modernization or a niche player with cult appeal, Finder’s data-rich engine helps investors and dealmakers zero in on opportunities that others miss.

Whether it’s a seasonal treat or a perennial favorite, being able to track market movement gives investors a tangible edge. Easter candies may be time-limited, but deal velocity doesn’t have to be. With our platform, the path from search to target is faster and smarter.

After all, in confectionery — as with any M&A deal — actionable intelligence will give you the competitive edge. Ready to source your deals smarter with our platform? Get in touch with us.